EU VAT Information

Lilliput Direct is based in the UK, and as such are not a part of the European Union. We are happy to accept and process orders from the EU, and to make the process as smooth as possible the below information should be considered before placing your order.

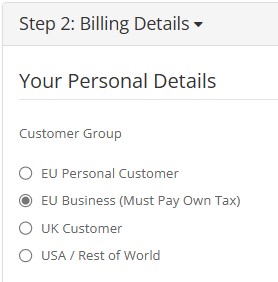

When you place

an order with us and proceed through the checkout process, in Step 2 - the “Billing Address” you will see there are some “Customer Group” options for you to choose from:-

If

you can choose the correct one of these that corresponds with your situation:-

EU

Personal Customer – Standard

EU Citizen purchasing an item. This will require you to pay the import tax at

the point of order, and we would make the payment for this to the courier on

your behalf at the point of shipping.

EU

Business Customer –

Registered EU Business. This would require you to pay the import tax / duties

to the courier as the package is en route to you. Please be sure to give

accurate and current email address and phone number details as the courier will

contact you to take the payment using them.

UK

Customer –

UK Based Citizen or Registered Business. VAT is charged at the point of order.

USA

/ Rest of World -

This would require you to pay the import tax / duties to the courier as the

package is en route to you. Please be sure to give accurate and current email

address and phone number details as the courier will contact you to take the

payment using them.

VAT

– or “Value Added Tax” is best defined as a consumption tax which is applicable

across a wealth of products, “Duty” is best defined as a charge made for

importing the goods into the country, and the “handling fee” is what the

courier charges for processing the package through the system.

**PLEASE NOTE** For countries / circumstances where the VAT /

Duty is paid by the customer to the courier, the rate of VAT and Duty would be

calculated by the courier company themselves per the shipment they receive.

This differs between country, however as a rule this is usually the standard

rate of VAT, plus a rate of duty, plus the above mentioned handling fee for bringing the item

into the country.